Australian businesses are collapsing at a dramatic rate not seen since the middle of the pandemic.

Fresh data released by CreditorWatch’s Business Risk Index has found business failures have spiked to a record high of an average of 5.04 per cent in October 2024.

The rapid rate of business owners shutting doors has been blamed on the cost of living crisis and mounting tax debts.

READ MORE: What the Reserve Bank is looking at when it sets interest rates

The last time companies failed at a rate higher than the previous month was in October 2020, at 5.08 per cent, when the COVID-19 pandemic was at its peak.

READ MORE: Word of the Year influenced by ongoing anger and backlash against supermarkets

Australia’s hospitality industry is struggling the most as customers look to curb spending.

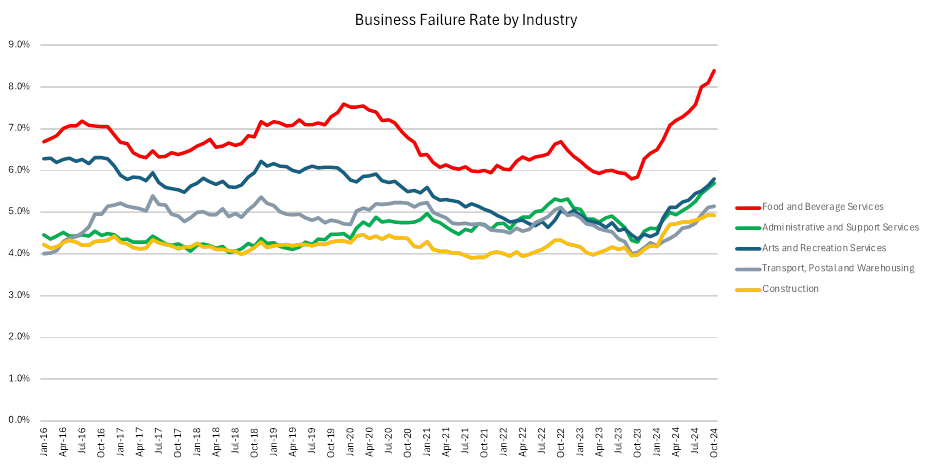

The food and beverage sector’s failure rate increased to 8.5 per cent in the 12 months to September.

And it will only get worse for cafes, restaurants and pubs, CreditorWatch predicts.

It forecasts the Australian hospitality failure rate will jump to 9.1 per cent over the next year, too.

According to the ABS Household Spending Indicator for September, the number of visitors and sales in hotels, cafes and restaurants was 1.7 per cent lower than a year ago.

The administrative and support services sector was the second worst hit industry, followed by arts and recreation and transport, postal and warehousing.

The construction and retail industries followed close behind with the same failure rate of 5.3 per cent.

Overdue taxes have been flagged as a big reason for businesses shutting doors.

CreditorWatch noted all sectors have seen a major spike in failures since the ATO ramped up collections in October 2023

Businesses in hospitality sector had the biggest average tax debts at over $100,000.

Among capital cities in Australia, Sydney is forecast to have the worst rate of business collapses in the next 12 months, followed by Brisbane, Melbourne and Perth.

READ MORE: What you need to know about Sydney’s train strike

Adelaide was named as the capital city with the lowest forecast failure rate.

“A slowdown in the inflation rate will certainly help businesses but we must remember this just means that price rises have slowed down, so the cost pressures remain,” CreditorWatch chief executive Patrick Coghlan said.

In most cases, you won’t see the cost of goods and services coming down.

“Businesses desperately need interest rates to come down so households have some relief in cost-of-living pressures and start spending more.”