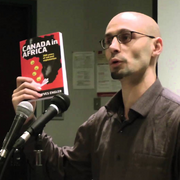

By Yves Engler

Have all Canadians underwritten $180 million of a billionaire power couple’s donations to a charity assisting a murderous military in violation of Canada Revenue Agency rules? How long until the CRA finally shutters a charity it never should have registered?

Canada finds itself in a controversial situation where the CRA has revoked the charitable status of the Jewish National Fund of Canada and Ne’eman Foundation, causing a ripple effect within the network of charities involved in fundraising for projects in Israel. The revocation brings attention to the questionable activities of various Zionist charities, including Gerry Schwartz and Heather Reisman’s HESEG Foundation for Lone Soldiers.

The CRA’s decision to revoke the Ne’eman Foundation’s charitable status raises concerns about the support these charities provide to the Israeli military, particularly to “lone soldiers.” This revelation has sparked a nationwide protest demanding the CRA to enforce the law against charities involved in supporting military actions and illegal settlements in the Israel-Palestine conflict.

– Yves Engler is the author of Canada and Israel: Building Apartheid and a number of other books. He contributed this article to The Palestine Chronicle. Visit his website: yvesengler.com.

[ad_2]

Source link